Our Business Model is designed in accordance with our strategy aimed to deliver prosperity and growth to our community and shareholders.

The need for quality affordable generics is still maintaining a high demand as governments struggle with their healthcare budgets in the face of increased pressures. Pharmacare endeavours to capture significant opportunities in this dynamic market environment in compliance with our acknowledged motto: “Pharmacare – An Expression of Trust”.

The Pharmacare Investment Niche

Recent Investments in Pharmacare PLC presents a gambol towards an uplifted trend business plan

Pharmacare: An Ambitious Player

Background

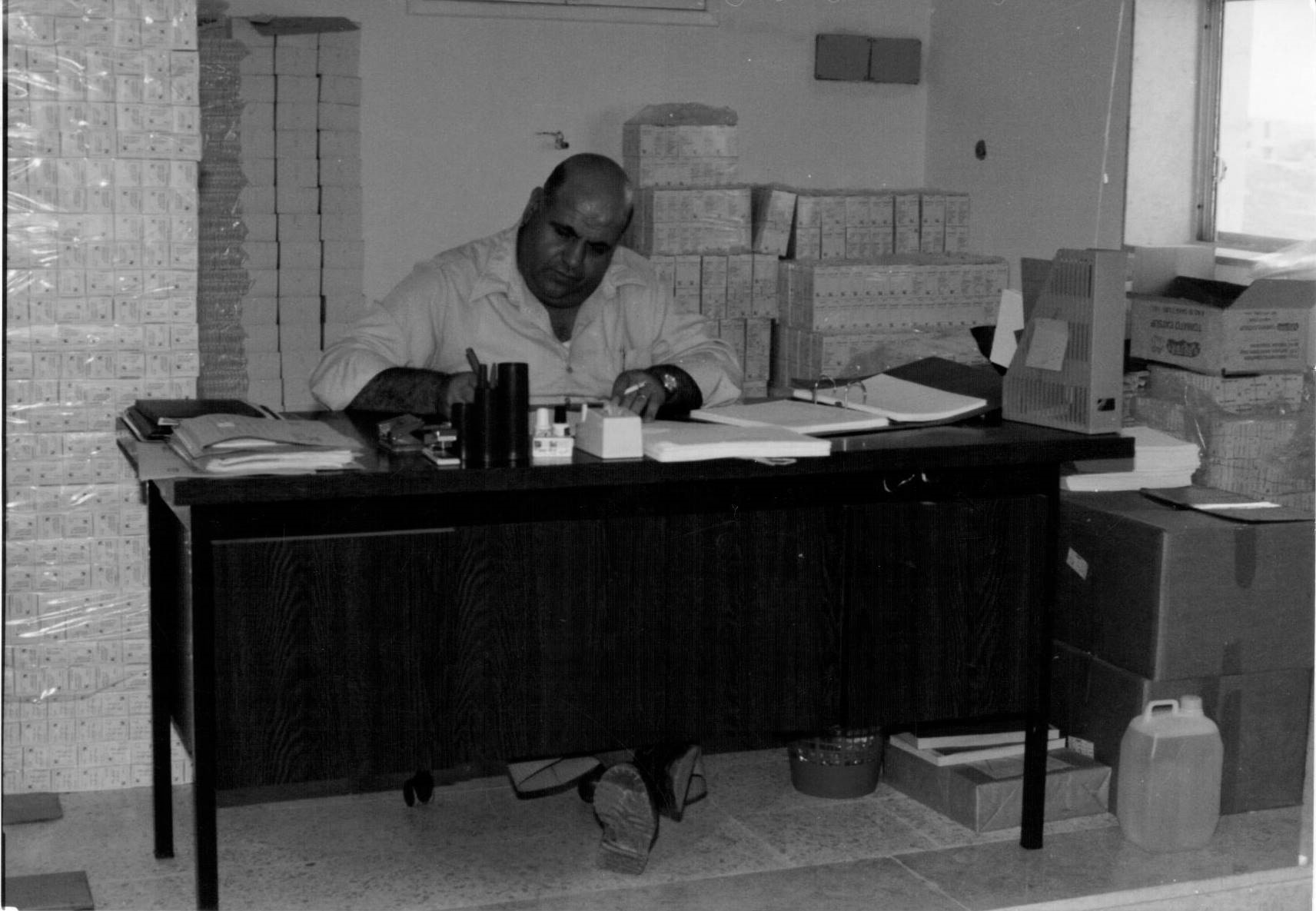

Pharmacare PLC was established in 1985 in Ramallah, Palestine, by the late Subhi Khoury, a pioneer industrial pharmacist active in the industry in Jordan and Palestine fromthe 1960’s. Since then it specialized in the manufacturing and distributing of human and veterinary drugs.From inception, Pharmacare was known for its high-quality products and its creative and developmental initinitiatives; this helped put it in a distinctive competitive position in the local market and facilitated its confident moves into international markets. Pharmacare managed to swiftly build an effective and high-quality operation, allowing it to be in the forefront of Palestinian pharmaceutical manufacturing with a 12% local market share.

pharmacist active in the industry in Jordan and Palestine fromthe 1960’s. Since then it specialized in the manufacturing and distributing of human and veterinary drugs.From inception, Pharmacare was known for its high-quality products and its creative and developmental initinitiatives; this helped put it in a distinctive competitive position in the local market and facilitated its confident moves into international markets. Pharmacare managed to swiftly build an effective and high-quality operation, allowing it to be in the forefront of Palestinian pharmaceutical manufacturing with a 12% local market share.

Today the Pharmacare Group also includes: Pharmacare Premium Limited, a Malta based manufacturing company specializing in oncology products; Pharmacare Global, a UK based distributing company and a Belarus based Pharmacare International responsible for the marketing and distributing in the CIS. The group also owns a 10% stake in IPI, the oldest Iraqi pharmaceutical company.

Pharmacare’s Mission

“Pharmacare is fully committed to fulfilling its obligations and acknowledged responsibilities towards customers, the society and the environment by means of producing high quality pharmaceutical products at affordable prices in order to preserve and improve quality of life”.

To preserve, sustain and improve ‘‘Quality of Life’’, Pharmacare endeavours to establish a Euro-Med alliance in pharmaceuticals and to bolster professional partnerships with regulators, medicinal authorities, physicians, pharmacists and end-users.

Pharmacare’s Vision:

“Pharmacare aspires to be the leader in the local Pharmaceutical industry by insuring that its products meet customers’ expectations in terms of quality, variety and value”.

Guided by the premise that employees are its foremost asset, Pharmacare invests in staff training and attempts to make its workplace both challenging and rewarding.

EMBLEM & MOTTO:

Ancient Canaanites, ancestors of current Palestinians, regarded wheat as a symbol of life, health and fertility, and hence used it as a decorative motif. This symbolic tradition survived to our modern times and is presently being used in key oriental embroidery. The ancient motif alongside its historical symbolism was adopted in 1985 as Pharmacare’s emblem.

In a commitment to life and health, Pharmacare pursues a policy of: Producing High Quality Products at Affordable Prices. Pharmacare exploits the latest technologies in manufacturing and quality, securing a competitive position in local and international markets. Total quality covers all aspects of operations, thus, living up to our adopted motto: “Pharmacare – An “Expression of Trust””

Strategic Partners

Operating in a highly demanding and competitive industry, Pharmacare saw the need to align itself with global innovators. In 1999, Pharmacare entered into a joint venture with the Wirtz family, owners of the German pharmaceutical company Grunenthal. This partnership and continued investments in Quality were of key importance for the implementation of standards and the attainment of the stringent European Good Manufacturing Practice certification (EU-GMP). Pharmacare became the first and only Palestinian pharmaceutical company to pass the German Medicine Authority’s audit; thus, acquired EU-GMP certification in 2008. The GMP certificate was successfully renewed in 2011, 2014 and 2016.

Steps Forward, the Strategic Plan “Pharmacare 2020”

Amid the present challenges with in the continuously fluctuatingnational and international pharmaceutical markets, Pharmacare took crucial steps to ensure that it will remain a serious player in the market.

In order to achieve a new breakthrough for the company, Pharmacare adopted a new overall corporate strategy in 2015 that fits the Pharmacare vision and mission. The six-year strategic plan: “Pharmacare 2020” included the various elements and goals, which Pharmacare intends to attain by the year 2020. This strategic plan aims to achieve the following:

- To contribute in strengthening the Palestinian economy through uplifting its productive base and offering new sustainable job opportunities for young people and expanding exports.

- Continuously upgrade the production capacity of Pharmacare by the continued development of operating procedures to comply with the ever-changing pertinent international standards to maintain high levels of Quality.

- To Maintain Pharmacare’s entrepreneurial and pioneering role in the manufacture of needed high Quality pharmaceuticals, thus maintaining Pharmacare’s policy of providing quality products at affordable prices.

- Expand Research and Development activities and innovation for development of new drugs using local resources in partnership with academic institutions.

- Develop the capabilities and scientific competences of the company’s employees, improve the working environment, motivating them and thus boosting their productivity.

- Continue to insure the company’s commitment to Corporate Social Responsibility and its commitment to the environment.

All pertinent departments within the company actively contributed to this strategic plan and all are involved in its execution. The goals of the Strategic Plan will be achieved through implementing various activities and measures, including the expansion of the buildings, introduction of new technology and equipment and continued training of technical staff.

Elements of the Strategic Plan

Implementation of this plan is presumed to allow Pharmacare to increase its production capacity by 100% and to also double its turnover over the next six years. This ambitious target would be achieved through the establishment of new production lines to cover novel dosage forms and a new range of products needed in the local and international markets. Thus, maintaining Pharmacare’s vision to remain an international partner manufacturing and supplying high-quality medicines, thereby enhancing confidence among its customers worldwide.

The total cost of implementing the “Pharmacare 2020” strategic plan is budgeted to be 17.3 Million USD. Funds will be provided through soft loans, loans from local banks and by allocating 50-70% of the company’s profits over the six years duration of the plan.

The New Expansion Project

A significant constituent of the strategic plan is the massive expansion project in Palestine embarked on in 2015. This expansion project was budgeted to cost €6.2 m ($ 8 m); and is being financed through various sources including: In-house assets, AFD (Agence Francaise De Development) €2.5 m loan, soft loans, grants, and loans from local banks.

Project Outcome

The new expansion project that Pharmacare is going through in Beitunia, Palestine, is one of the components of the strategic plan “Pharmacare 2020”. The €6.2 m ($8 m) expansion plan that was mentioned (and is in the process of implementation) will achieve the following for Pharmacare:

- Upgrade its key production facility allowing an increase in batch sizes and quantities being produced, thus increase its local production capacity.

- Keep up with the ever-changing international pharmaceutical industry standards, secure the validity of its antibiotics facility, and maintain Local and International GMP certifications.

- Invest in new equipment and infrastructures and extend its production capacity to new types of pharmaceutical products (soft gel).

The project will insure increased employment by creating around 40 new jobs, in addition to some great benefits for the company, including increased output, and reduced unit cost, thus having a dramatic increase in profitability. These positive results will insure the continuity and competitive edge of Pharmacare in both the local and international markets.

The described investments are of a strategic, threshold-type nature both for Pharmacare as a company and for Palestine, as it is its market and place of production. Their implementation would produce a range of positive effects for Palestinian wellness, its economic development, and its people; through the provision of reliable supply of high quality medicines at competitive prices.

To achieve the above, Pharmacare will invest in the following four major components:

- Increasing Production Capacity through Increasing Batch Size:

Pharmacare’s annual capacity in Palestine is 200 million tablets. To be a serious player in generics, and to insure efficiencies and competitiveness, it is a must to be able to produce at least 500 million. The bottle neck in this operation is caused by the Fluid Bed Dryer. The current equipment is excellent but has a small capacity; holding back production considerably. Pharmacare’s equipment operated at a maximum of 30Kg; batch size was increased to 120Kg.

Production area was 1500 square meters, with the expansion plan, total production area will become 3300 square meters. Warehouses which were 600 square meters will increase to 1,600 square meters.

- Purchase of production related equipment:

In order for Pharmacare to be able to achieve the other components of this project; increasing in production capacity, upgrading of antibiotics facility, and the introduction of a soft gel line it needs to purchase production related equipment. Those include; HVAC equipment, dehumidifiers, lifts, pharmaceutical equipment and machines.

- Upgrading the antibiotics production facility:

While Pharmacare’s other facilities operate at the highest international standards and are, as a result, GMP certified, the penicillin & cephalosporin (antibiotics) production facilities have become outdated. Pharmacare plans to update and upgrade its antibiotics production facility as soon as possible, to enable it to also be GMP certified like the rest Pharmacare’s facilities. Thus, allowing exports from these facilities. It is essential to highlight that if Pharmacare did not implement this upgrade this will deny the local market as well as the MOH the benefits of high quality competitive products.

- Developing Novel Soft Gel Production:

Part of the loan will be invested in this new technology that is novel to the Palestine pharmaceutical industry. As a result, such products are currently only available through imports from abroad. Producing in Palestine will ensure supply to the local market and to the MOH of these highly needed products at much more competitive prices. This will enhance Pharmacare competitive advantage and will allow it to grow both locally and internationally.

Project Outputs

Following are illustrations of the effects of implementation of the project. They include:

Effect on Production outputs

Upon the completion of the Expansion Plan, units produced at Pharmacare will increase from 6.68 million to around 14 million. This translates to more than doubling of production capacities and outputs.

Effect on Employment

Upon the completion of the Expansion Plan, the number of employees in production working at Pharmacare will increase from 125 to around 165. This translates to an increase of around 30%. Thus, a total of 38 new jobs will be created.

Effect on production unit costs

Effect on Pharmacare’s Profitability

| 2017 Actual | 2019 projections | |

|---|---|---|

| Production (in units) | 6.682.432 | 14.000.000 |

| Sales of manufactured goods in USD | 17,373,224 | 30,000,000 |

| Gross Margin | 6,613,836 | 15,000,000 |

| Gross Margin % of Sales | 38% | 50% |

| Sales & Marketing Expenses | 2,340,783 | 2,808,940 |

| Sales & Marketing Expenses % of Sales | 13% | 9% |

| Administration & Finance Expenses | 2,146,341 | 2,575,609 |

| 12% | 9% | |

| Net Profit from Operations | 2,126,712 | 9,615,451 |

| Net Profit from Operations % of Sales | 12% | 32% |

The most dramatic effect that is expected to be seen is that on the profitability of Pharmacare. With reduced production costs per unit and if we manage to increase sales of manufactured goods to USD 30,000,000 (something that is doable with the novel production lines we will have), profits from operations will go up from 12% to 32%. An increase of 7.488 million USD is almost equal to the Total Project costs of 8 million USD.

The Pharmacare Investment Case

Designed in accordance with our strategy, our business model aims to deliver high Returns on Investments (ROI) to our shareholders and investors, as well as growth to our community.

The need for quality affordable generics is still acute as governments struggle with their healthcare budgets in the face of increased pressures. Pharmacare endeavours to capture significant opportunities in this dynamic market environment in compliance with our acknowledged motto denoting "Pharmacare - An Expression of Trust"

Our Business Model

At Pharmacare, we try to promote successful returns to our shareholders, end-users and the wider community by means of a versatile business model tackling possible challenges and expected impediments.

Our Potential Inputs:

- Team: Our workforce is composed of highly qualified, devoted and sincere staff from a variety of professional backgrounds

jointly completing the circle towards a successful formula. - Ethics: In compliance with the work ethics in accordance with our Code of Conduct, we thrive to achieve a sustainable and well-reputed business.

- Financial Potential: Our capital investment expenditure in Technical Development and manufacturing facilities enable the enrichment of our product portfolio and geographical expansion.

- Manufacturing Potential: Our manufacturing facilities are based on the strictest GMP standards correspondence to utmost operational excellence and efficiency.

- Networking: Our good interrelations with health authorities, regulators and partners help resolve different modes of impediments and punctures.

Our Mission:

“Pharmacare is fully committed to fulfilling its obligations and acknowledged responsibilities towards customers, the society and the environment by means of producing high quality pharmaceutical products at affordable prices in order to preserve and improve quality of life”.

To preserve, sustain and improve "Quality of Life", Pharmacare endeavours to establish a Euro-Med alliance in pharmaceuticals and to bolster a professional partnership with regulators, medicinal authorities, physicians, pharmacists and end-users.

Pharmacare Activities in Action:

At Pharmacare, we endeavour to fulfil our obligations and commitments to assure the best and fairest returns towards our clients, end-users and wider-community.

We dwell an unusual geographical location by which our business manoeuvres are unconventionally governed. This appears to be reflected in the mental psychology and the percentage of chronic diseases witnessed among the wider community. Amid the pressures and the vast external competition, Pharmacare endeavours to bring about the best quality medicines for the most affordable prices to maintain its acknowledged relationship with the diverse clients and end-users pertaining to An Expression of Trust.

At Pharmacare, our core work is focused on the development of a broad spectrum of differentiated portfolios of generic, branded generic, in-licensed human and veterinary products through in-house Research and Development, Co-development Partnerships, Licensing Agreements and acquisitions.

Today the Pharmacare Group consists of a number of facilities in the Middle East and Europe. It includes: Pharmacare PLC, Pharmacare Premium, Pharmacare Global, and Pharmacare International. The group also owns a 10% stake in IPI. This consort of subsidiaries pioneers Pharmacare’s potential serving a variety of communities globally, thus providing various conventional lines in response to the marked communities’ market demands.

Quality Maintenance:

Pharmacare sets a local example in its adherence to GMP guidelines and has demonstrated among its various global subsidiaries to have sought the most prestigious c-GMP-approved levels of manufacturing practice providing top-notch quality products. Together with its intricate criteria of target production, this strategy accounts for Pharmacare’s successful formula implying national leadership and international expansion.

A correlation between the enhanced demand for pharmaceuticals within the Pharmacare target markets and the governments’ efforts to secure quality healthcare for affordable prices pronounces the model upon which Pharmacare Pharmaceuticals stands. The above inputs are expedited by a range of socio-political factors, rendering Palestine, embedding the headquarters of the Pharmacare Group, an unusual niche accommodating unconventional pros and cons:

Marketing Across Geographics

Our assets at Pharmacare are governed by a professional team of sales and marketing that is amalgamated to complement the standards of quality manufacturing by means of EU, ANIVISA and Palestinian GMP certifications. Pharmacare presents a team of over 50 sales and marketing personnel engaged in marketing our products to a variety of clients, including doctors and pharmacists, wholesalers, pharmacy chains, government and hospital purchasing organisations.

Making a Difference:

The implementation of our Business Strategy is anticipated to enable Pharmacare to increase its existing production capacity and to double its turnover over the coming years.

Units Produced per Year

Number of Production Employees per Year

Cost per Unit Year - NIS / Unit

OurStrategic Scheme

We aim to follow our acknowledged motto reflecting An Expression of Trust within our community and over our varioustarget markets. In pursuit of our promise, we have composed a Strategic Plan to help an up-to-date keep-up tract in seek of the most highly-on-demand products of the finest quality and the most affordable rates.

Performance

Pharmacare’s financial and non-financial reporting is directed by its various internal committees. The data and information collected acts as a guide for monitoring and evaluating the company’s performance and sustainability strategy. We perceive our transparent reporting as a major factor behind the improvement of our business.

Pharmacare’s non-financial reporting is directed by management. The data and information collected serves as a guide for reviewing and adjusting the sustainability strategy. We firmly believe that transparent reporting helps us improve our business. We are dedicated to communicating precise, clear and balanced information to our stakeholders.

Reporting scope

We provide integrated information about the Pharmacare Group financial and non-financial recording within our Annual Report, Quarterly Reports and Sustainability reports, covering all regions and divisions from 1st January to 31st December 2017.

Major highlights pertain to general trends reflecting business of our headquarters in Palestine.

Total Sales in NIS

Size of the Pharmacare Generic Prescription Market - NIS

64300000

Market Growth (1986 – 2016) - CAGR %

92

Global generics market

The Pharmacare Generic Prescription Drug Sales (1986 – 2017)

The Pharmacare generic growth trajectory market has made up to NIS64.3 m in 2017.

Both local and global pharmaceutical markets has been impacted by key trends in recent years, including buying consolidation, macroeconomic instability in key markets and reduced government healthcare budgets. Those prove especially relevant in developing countries and in those where political conflicts have prevailed. These changing dynamics are creating opportunities for generic pharmaceutical companies, as the need for more affordable healthcare solutions is driving an increment in generic penetration.

Our Markets

of Group’s production output (2017, 28%)

of Group’s production output (2017, 37%)

of Group’s production output (2017, 26%)

Key Financial Figures: